Following our earlier exclusive expose Sarawak Report has unearthed further exclusive evidence proving the links between the mystery tycoon Jho Low and Malaysia’s sovereign wealth fund One Malaysia Development Berhad (1MDB).

It shows that in 2011 1MDB bankrolled a multi-million euro debt buy-out in Ireland, which formed a key plank in Jho Low’s strategy to get a controlling share of a London Hotel chain for his Wynton private equity group.

This new evidence flies in the face of denials as late as last month by Low that he has had any involvement or received any benefit from the public fund.

It also calls into question why 1MDB’s chief officer claimed recently that the role of Jho Low in IMDB was “zero”.

The chairman in charge of the sovereign wealth fund is the Prime Minister Najib Razak himself, who established its foundation as one of his first actions after taking office back in 2009.

Low admits to being a close friend of the Prime Minister’s wife and her son Riza Aziz, who credited Low at the end of his Hollywood blockbuster Wolf of Wall Street with a notice of ‘special thanks’.

Irish debt buy out

In our earlier expose Sarawak Report revealed how Jho Low and his private equity company Wynton Group were backed by 1MDB in a failed attempt to buy out the London hotel company that owns Claridges.

Justice David Richards detailed in his judgement on a related case how as part of his bid Low purchased debt in the hands of Ireland’s National Asset Management Agency (“NAMA”), which had been taken over from a distressed property tycoon Derek Quinlan.

The purpose was to give Low greater leverage in the hotel group on which the debt had been secured:

“Mr Low persisted in his interest and in April 2011 he acquired a debt due from Mr Quinlan to NAMA which was secured on part of Mr Quinlan’s shareholding in the company, bidding more for the debt than the Barclay interests were prepared to pay. The debt was acquired through an associate company called JQ2. This too was a clear demonstration of serious interest in the company.”[Patrick McKillen v. Misland (Cyprus) Investments Ltd & 10 others]

But, where did the youthful Penang born businessman, who admits his family is not especially wealthy, find the money to buy out this debt amounting some €60million?

The judge did not explore this matter of funding, which was not directly relevant to the case he was adjudicating. However, there was plenty about it at the time in the Irish Press, since Quinlan was a famous local businessman.

Tellingly, these press reports make no mention of Jho Low, because the actual funder behind the purchase of this debt, according to the Irish Independent and other news outlets, was none other than Malaysia’s sovereign wealth fund One Malaysia Development Berhad (1MDB)!

“Oil-rich Malaysia’s sovereign wealth fund 1Malaysia Development Berhad (1MDB) is thought to be interested in buying bank loans associated with Derek Quinlan’s stake in the €1.2bn-valued Maybourne hotel group in London, which owns the landmark Claridge’s, Connaught and Berkeley hotels. The investment fund, owned by the Malaysian government, is believed to have approached Nama over buying the loans. Subject to certain conditions, 1MDB could then take a stake in the hotel group if any of the loans turned bad under a debt-for-equity deal. However, sources have indicated that Nama was initially reluctant to engage with 1MDB despite the size of its coffers. The fund is one of the biggest investment groups in the world with advisers including French billionaire Bernard Arnault. Nama declined to comment. The fund has already invested in a number of real estate and infrastructure projects around the world, including a $2.5bn joint venture with PetroSaudi and a scheme to create a carbon-neutral city in Malaysia”,[Irish Independent 21st February 2011]

Jho Low bankrolled by 1MDB

So, it is clear from the coverage of the deal that the recognised bidder for Quinlan’s Nama debt was understood in Ireland to be not 26 year old college grad Jho Low, but the deep pockets of the public fund 1MDB.

This debt purchase was an integral part of Jho Low’s private equity bid to take over the controlling shareholding of the Coroin Hotel group in London and the UK court judgement makes clear that he was the man who fronted the approach to Nama and who had purchased the shares through a company associated with the Wynton Group called JQ2 (see above).

Later on 17th April the Irish Independent confirmed the deal had taken place. Yet, again, the Irish newspaper coverage referred to a purchase by 1MDB and not Jho Low. It had brought a fat €60million (RM271million) profit to the Irish asset management agency Nama:

“As Derek Quinlan’s property empire staggered last week, it has emerged that Nama made a hefty €60m profit by flipping developer Quinlan’s Claridges Hotel loans to the Malaysian outfit OneMBD (sic). OneMBD’s battle for Claridges was first revealed by the Sunday Independent in February.[Irish Independent]

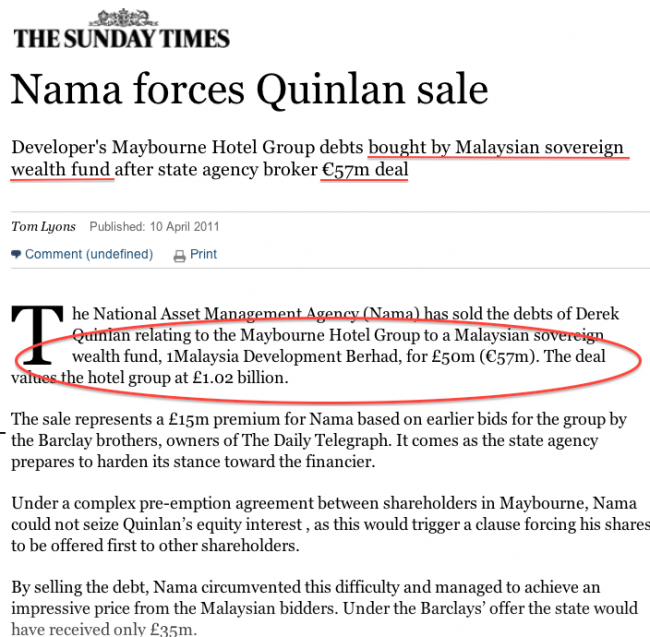

The UK’s Sunday Times newspaper also covered the story and likewise reported that the purchaser of the debt was 1MDB:

The coverage therefore leaves little doubt that Jho Low’s bankroller in this multi-million ringgit purchase of debt (at great profit to the Irish) was none other than 1MDB – and it was the real funder, Malaysia’s sovereign wealth fund, which gained the attention of the press rather than the private equity partner, Jho Low of Wynton Group/ JQ2!

Time to start telling the truth about Jho Low and 1MDB?

Given the constant string of denials from both Jho Low and 1MDB that the youthful playboy has any ties whatsoever to the sovereign wealth fund and its investments this matter requires immediate explanation.

Why is Malaysia’s sovereign wealth fund, which is supposed to be investing in development in Malaysia, evidently funding risky private equity ventures by Jho Low’s companies?

Does this all mean that Jho Low is in fact the lead investor for 1MDB and if so what is his profit margin?

Or is Jho Low in fact just a front for other investors who can’t be named?

Finally, does not Jho Low’s involvement with 1MDB and his known close friendship with the family of its Chairman, Najib Razak, provide the most convincing explanation up to date for his, so far undisclosed, sources of investment income and his extraordinary sudden wealth?

Surely, the Malaysian public have a right to know if its development funds are being handled and invested through the private equity transactions of this high-spending, night-club addict who is still in his 20s!