The two criminal indictments laid by the US Department of Justice against the former Goldman Sachs South East Asia boss Tim Leissner and separately against his colleague Roger Ng and 1MDB proxy Jho Low make clear that these three men do not stand alone in their sights.

A series of devastating revelations and assessments point to a culture at Goldman Sachs (referred to throughout as ‘U.S. Financial Institution #1’) that promoted the closure of lucrative deals above the inconvenience of compliance and due diligence. Knowledge of this made it possible for Goldman’s Southeast Asia boss, Tim Leissner, to push through the 1MDB bond transactions despite major concerns and misgivings expressed by oversight committees within the bank.

Although the charges make clear that Leissner and Ng set out to deceive the oversight bodies in that they:

“knowingly and willfully conspired to circumvent and cause to be circumvented a system of international accounting controls at [Goldman Sachs], contrary to the FCPA [Foreign Corrupt Practices Act],

the documents insist time and again that this deliberate deception was was made possible by the bank’s own failings. There are numerous clear references to wider culpability at the bank and also to the fact that others working alongside the two men also knew what was going on, but failed to blow the whistle.

Moreover, the UK based Financial Times has reported there were in fact at least 30 employees at the bank who reviewed the deals including bank boss David Solomon and his predecessor, Lloyd Blankfein and yet apparently found nothing wrong.

The paper also identifies an ‘Italian’ partner at the bank cited in the court documents as Andrea Vella, who has long been whispered as one of the key senior parties involved. Vella has been put in leave following the allegations (he also faced controversy over his involvement in the bank’s highly controversial dealings in Libya where it was also accused of milking a weak government of the country’s cash).

For now the DOJ is not naming names, however there are references to a senior figure in New York, who was brought to meet Najib in the presence of Jho Low (a red flag in itself) and to colleagues who knew at every stage that Jho Low, who had been banned by the bank’s compliance department, was involved in the 1MDB deals, despite the fact that Leissner and Ng were failing to report his intermediary role to relevant parties. Worse, they were denying it when directly questioned.

Bribed

The indictments explain why Ng and Leissner were willing to carry out the frauds against 1MDB, in that millions of dollars in cash rewards were sent to their accounts and accounts of their relatives from the money that was stolen and siphoned out to the false BVI Aabar accounts from the so-called Power Purchase bonds and Strategic Partnership bond the bank raised for 1MDB.

It is calculated that Leissner himself received some $200 million in proceeds. Others in the bank also had a financial incentive for their complicity in that they all received bumper bonusus as a result of keeping quiet.

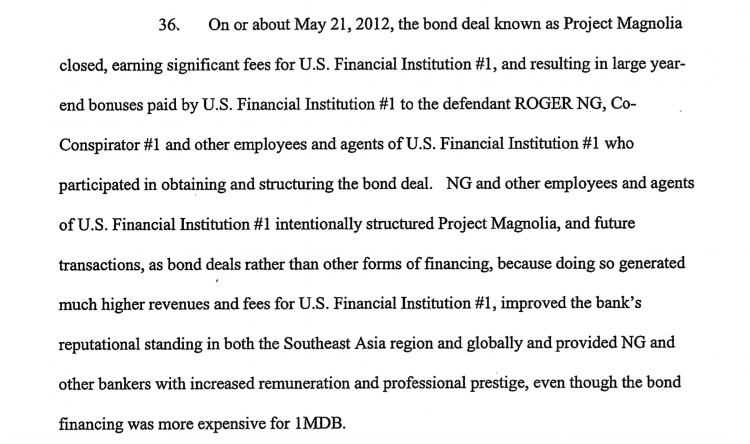

Perniciously, the indictment also points out the damning fact that the financial advisors and experts from Goldman Sachs had knowingly and deliberately conjoured up a far more expensive instrument for financing 1MDB’s various investments than was necessary, namely the three bond arrangements totalling $6.5 billion, purely in order to get more money out of the Malaysian taxpayer for the benefit of the bank:

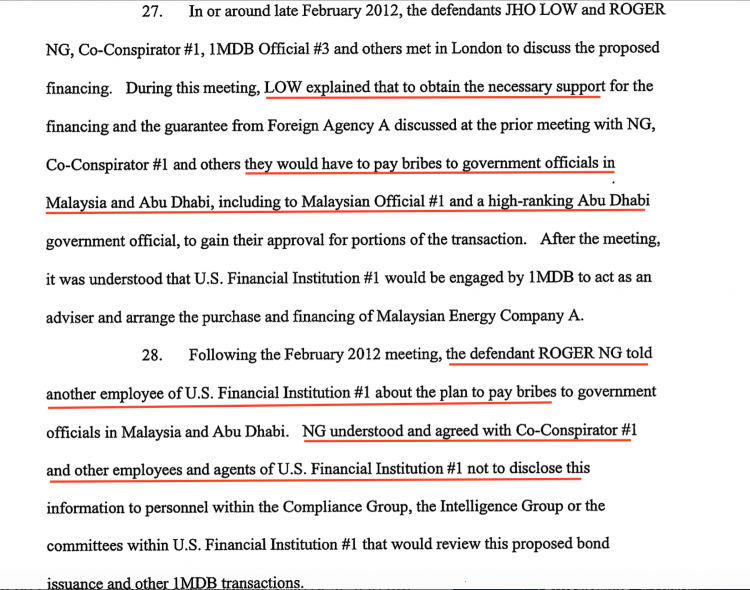

Not only that, the FBI investigators detail how from the outset Jho Low met with these senior bankers along with top officials in 1MDB (including the legal counsel Jasmine Loo, ‘1MDB official #3’) and explained how key officials in Malaysia and Abu Dhabi, including the ex-prime minister and his wife, would need to be bribed as part of the operation.

The meeting took place in February 2012 in London and after that Ng and Leissner (‘Co-Conspirator #1) informed colleagues at Goldman Sachs about the need to pay bribes to Najib and the Chairman and CEO of the Aabar sovereign wealth fund in Abu Dhabi, who all agreed to hide the matter from their compliance teams:

Cakes To Madame R

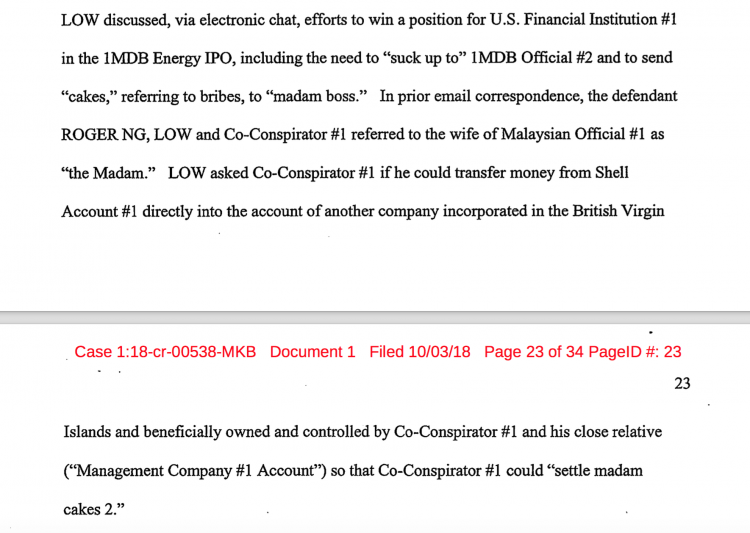

The bankers had concurred, say the indictments, which then go on to describe exactly how what were termed as ‘American burgers’, ‘cakes’ and ‘pies’ were distributed by the conspirators to ‘Madam R’ or ‘Madam Boss’ as the wife of Najib was described in emails between them. ‘Pies’ were also distributed to Najib, the Abu Dhabi officials who set up the bogus off-shore structures and the conspirators themselves.

Tim Liessner even on occasion allowed one of his own personal accounts to be used to ferry some of the stolen 1MDB cash to Rosmah as a favour to Jho Low:

A Structure Of Oversight Easily Evaded By Dealmakers

The indictment describes how although America’s most powerful bank had an impressive structure of oversight and compliance teams, which were actively looking at their biggest ever series of Southeast Asia deals in this case, the dealmakers around Tim Leissner and Roger Ng set out with the knowledge they could get around these safeguards against corrupt practice.

This was despite the fact that Goldman’s Compliance Group and Intelligence Group had already identified Jho Low as a toxic individual, who the bank had vetoed doing business with:

“muliple groups at [Goldman Sachs] had responsibility for managing and overseeing many of these compliance policies, including an anti-bribery policy… These committees were responsible for reviewing, among other things, the compliance and reputational risks of the transactions. The firmwide committee included high-level executives at [Goldman Sach’s] headquarters in New York.

Before and during the three 1MDB bond deals, compliance personnel and committee members were focused on whether these and other transactions involved [Jho Low] – an individual with whom compliance and legal personnel at [Goldman Sachs] had determined [they] should not do business. [DOJ Indictment of Tim Leissner]

The revelation that Goldman Sachs’ compliance and legal teams had already barred doing any business with Jho Low represents a major blow for the bank, since the entire world knew and was talking about Jho Low’s involvement with 1MDB and yet Leissner and Ng were able to get the deals passed.

Although the indictments make clear that Leissner and his colleague Roger Ng did their best to keep Jho Low’s involvement in the 1MDB deals under wraps – on a number of occasions lying to officials from Goldman’s Compliance Group and Intelligence Group – they also make clear that these oversight bodies simply failed to dig deeper beyond gaining Leissner’s word that Jho Low was not involved. This at a time when it was common knowledge that Jho Low was the influential advisor to Najib over 1MDB.

The reason was that the culture of the bank promoted the ‘dealmakers’ above compliance:

“U.S. Financial Institution #1 [Goldman Sachs]‘s internal accounting controls were overseen and enforced by its compliance function (the ‘Compliance Group’) and part of its legal department, referred to internally as the “Business Intelligence Group” (the “Intelligence Group”). These groups worked in conjunction with, and as part of, various committees in reviewing transaction, including the three 1MDB bond deals, for approval. However, the business culture at U.S. Financial Institution #1 [Goldman Sachs], particularly in Southeast Asia, was highly focused on consumating deals, at times prioritizing this goal ahead of the proper operation of its compliance functions” [DOJ Indictment of Jho Low and Roger Ng]

In other words the intelligence and compliance divisions of this major institution were willing to rely on the word of Tim Leissner to dispel concerns they plainly had about the involvement of the mysteriously wealthy and politically connected Jho Low in the 1MDB bond deals underwritten by the bank, mainly because the culture at the bank prioritised cutting deals over “the proper operation of its compliance functions”.

The content of the indictment shows that the blind eye turning went further. On no less than three occasions Tim Leissner tried to persuade his reluctant bank to take on Jho Low as a client in their “Private Wealth Management” (PWM) division, despite being flatly told that the ‘appetite of the bank’ was “zero” for this potential client, given the nature of his unexplained wealth and prominent media profile as an ostentatious spender.

During these attempts Leissner had made clear to the PWM division that Jho Low was an important partner in the bank’s Malaysian business. Even so, the bank later went on to accept Leissner’s word that Jho was not involved in 1MDB and appears to have taken no steps to check if their executive was telling the truth, despite his clear vested interest in Jho Low and 1MDB.

It got worse, because the indictments go on further to show that Tim Leissner stuck out his neck once again by seeking to get the bank to stump up a staggering $300,000 donation for Rosmah’s Permata organisation, to be presented during her promotional visit to New York. Goldman Sachs’ hierachy refused.

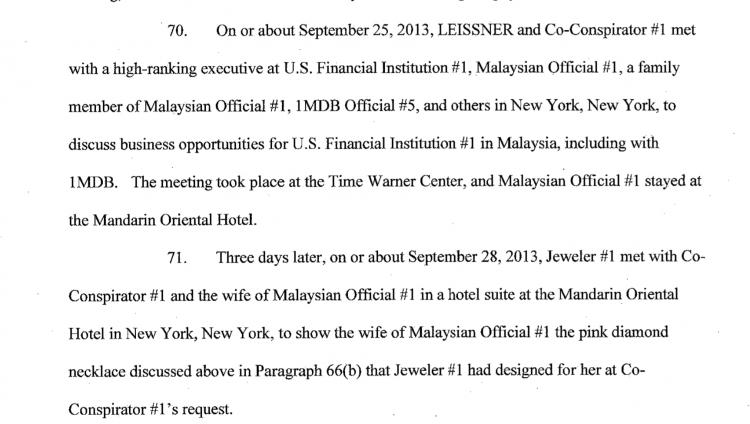

Even more indicatively Leissner organised for a high level meeting to take place in New York in September 2013 between MO1 (Najib Razak) and unnamed senior figures of Goldman Sachs at which Jho Low and himself were present. A ‘family member’ of Najib’s was also present, who is presumed to be Riza Aziz.

Such indicators ought to have surely raised red flags at the bank that the person it had ‘zero appetite’ to do business with was indeed closely connected to their best Southeast Asia customers at 1MDB. As a result Goldmans needed to do more than just keep taking the word of the bogus ‘Dr’ Leissner, their new Southeast Asia head.

However, the bank did nothing until well after Sarawak Report published documents showing that billions had been diverted from 1MDB. Roger Ng departed in 2014, yet Leissner did not leave the bank until February 2016, on grounds that were made out as having nothing directly to do with misappropriation from the fund.

Indeed the indictment goes on to baldly state that others at Goldman Sachs, beyond Leissner and his co-conspirator Roger Ng were well aware of Jho Low’s role:

“The defendant Roger Ng, [Leissner] and other employees and agents of [Goldman Sachs] knew that the defendant Jho Low played a central role in the bond transactions, including by acting as an intermediary between [Goldman Sachs], 1MDB and other Malaysian and Abu Dhabi government officials.

Ng, Leissner and other employees and agents of [Goldman Sachs] also knew that bribes had been promised to these officials to secure 1MDB business for U.S Financial Institution #1.

Ng, Leissner and other employees and agents of [Goldman Sachs] conspired to conceal that and other information from [Goldman Sachs’s] Compliance Group and Intelligence Group to prevent those groups from attempting to stop U.S. Financial Institution $1 from participating in the lucrative transactions” [Indictment of Jho Low and Roger Ng].

What the above dry language makes clear is that the DOJ has identified there were a number of people at the bank besides the duo currently facing charges who were perfectly aware of what was going on at 1MDB and about the involvement of the toxic individual Jho Low. These people knew that Leissner and Ng were lying.

None of this is surprising, since the matter was perfectly obvious to casual onlookers from outside the bank as well.

Goldman’s Culture Put Profits Before Compliance

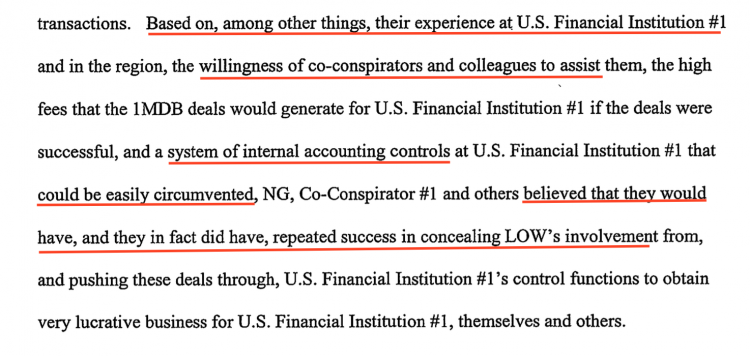

The finger pointing by the DOJ towards a broad and deliberate institutional failure by America’s most powerful bank, as opposed to a fraud perpetrated by a few individuals within it, continues in this devastating indictment. In paragraph 20 of the charge against Jho Low and Roger Ng

“Based on, among other things, their experience at [Goldman Sachs] and in the region, the willingness of co-conspirators and colleagues to assists them, the high fees that the 1MDB deals would generate for [Goldman Sachs] if the deals were successful, and a system of internal accounting controls at [Goldman Sachs] that could easily be circumnavigated, NG, [Leissner] and others believed that they would have, and they in fact did have, repeated success in concealing Low’s involvement from, and pushing these deals through, [Goldman Sach’s] control functions to obtain very lucrative business for [Goldman Sachs], themselves and others.

If Goldman Sachs are planning to dismiss the 1MDB fiasco as the fault of rogue bankers therefore, the all powerful bank has a battle on its hands. The DOJ indictment takes care time and again to assert the knowledge and involvement of others at the bank, who knew what these senior players were up to every step of the way.

The incentive was money for all concerned at the bank and a huge step forward in prestige in the region, which open up the prospect of further lucrative business. Goldman Sachs was a key and willing player at its most senior levels in the biggest kleptocracy scandal in history and America’s most powerful bank together with its famed ‘Masters of the Universe’ hierarchy ought to reap the consequences of that criminal engagement.

See the Indictment against Jho Low and Roger Ng click here

See the Indictment against Tim Liessner (to which he pled guilty) click here