Global observers are already scratching their heads over Sabah’s so-called Nature Conservation Agreement, whereby the Deputy Chief Minister is pushing two million hectares of forest lands into the hands of a mysterious off-shore company to tout for carbon credits.

Now it has emerged that another private operator is pushing to make a massive profit out of the cheap purchase of a further 280 thousand hectares of forest lands, also thanks to apparent assistance from the top.

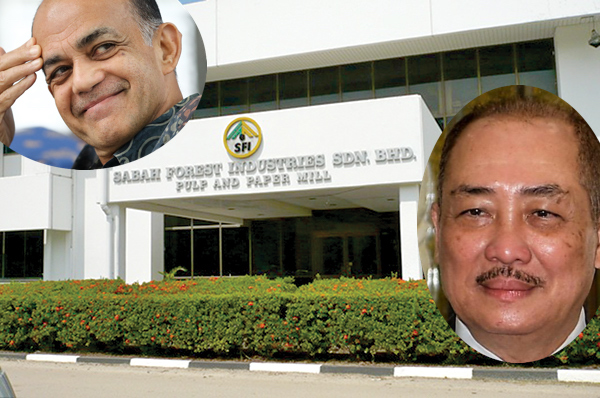

This time it is Malaysia’s best known ‘crony capitalist’, Syed Mokhtar Al-Bukhary, who has benefitted from a bold move by the state leadership to fly in the face of rulings from the courts in order to hand the tycoon a vast swathe of forest and plantation land, previously owned by Sabah Forest Industries (SFI), plus a valuable pulping plant, for a fraction of its market value.

The irony is that back in 2017 when SFI was first put up for sale the self-same Syed Mokhtar had agreed to pay the actual value of the asset, namely RM1.2 billion.

However, it seems that Chief Minister Hajiji Noor is now prepared to issue a compulsory order to take over the entire area, having gazetted it in the ‘public interest’, in return for an alleged ‘compensation offer’ of only RM256 million to be paid by Mr Mokhtar to whom the state plans to immediately hand it on to!

Outraged opponents, who had just won their legal battle to prevent the land being taken over by Mocktar through other means, are pointing out that the law on compulsory purchase orders by the government only applies to land appropriated for the public interest, not the private interests of the likes of Syed Mokhtar – and whoever else might be quietly in league with him to profit from such a sweetheart deal.

The courts have already put a stay on the order. Yet, should the deal be eventually judged illegal, it will be the people of Sabah who will likely have to pay out the compensation to the injured parties, which may well be after those presently responsible have been voted out of office.

As such, this matter threatens to yet again defraud the people of Sabah, many of whom have already lost their jobs, homes and promised compensation thanks to the incompetent and shady handling of the disposal of SFI amounting to loses claimed to be in the hundreds of millions.

Meanwhile, say outraged onlookers, SFI land is already being logged and exploited by Syed Mokhtar’s partners, who include neighbouring Sarawak’s notorious Press Metal Bhd which owns an infamous aluminium plant in Mukah.

“The raping of SFI continues whilst matters are still under Judicial Review in the Courts and Arbitration in the AIAC….. Press Metal Berhad has been extracting SFI acacia logs from SFI’s 50,000 ha plantation lands and exporting them to Bintulu using the SFI jetty which they have forcibly entered and taken over with the help of police ‘maintaining peace and order’.”

claims one informed insider whose allegations Sarawak Report has not yet been able to independently confirm.

What Has Been Going On?

So how has a shadowy consortium dominated by a key concessionaire and Sarawak’s aluminium smelter taken control of this huge stretch of Sabah?

The immediate issue goes back to 2007 by which time this enormous tract of land in the supposedly ‘independent’ state of Sabah had fallen into the hands of the Lion Group which then fell into financial difficulties over its extended holdings.

Lion Group sold out to Ballarpur Industries, a paper manufacturing concern owned by the billionaire Indian ‘entrepreneur’, Gautam Thapar, which acquired a 98% stake in SFI for RM991 million that year.

Gautam Thapar, however, turned out to be an accused fraudster, who has been jailed since last year in India pending charges. Meanwhile, as his business empire collapsed it emerged he had leverage hundreds of millions using SFI as collateral to fund his various debts.

The result was that in 2017 the receivers representing major banks moved in to raise as much money as possible to dispose of the asset, whilst keeping the project as a going concern on which 2,000 Sabah workers depended for their livelihoods (along with some 6,000 dependents and family members living in the now desolated town of Sipitang).

It was at this point that Syed Mokhtar made his move, backed by the then UMNO state government of the discredited former chief minister Musa Aman.

The government licensed monopoly rice importer, long favoured by UMNO/BN, agreed to put down a RM120 million (10%) deposit on an agreed purchase price of RM1.2 billion for the asset.

This was accepted by the receivers for the banks despite clear concerns that the newly minted 2 ringgit company that Mocktar created to own and manage his interest had no track record in the timber and pulp& paper industry.

Indeed, given Malaysia’s record of rent seeking by government cronies it was legitimate to suspect that the tycoon merely planned to sub-contract the entire process to a more qualified operator in return for a hefty commission for himself and any partners behind the scenes.

At which point the election of 2018 unseated the corrupted Musa Aman and PH’s Shafie Apdal took office as chief minister. After scrutinising the deal Shafie imposed new requirements to better ensure a proper operation of the project. This included bringing in a qualified joint venture partner with the required expertise to manage SFI.

The receivers tendered the opportunity which was awarded to a HK-listed pulp and paper player, Lee & Man Paper. Both the Sabah government and Mokhtar accepted Lee&Man.

However, the deal then started to founder owing to the failure by Mokhtar to fulfil the terms of his original purchase, according to an insider close to the receivers who has spoken to Sarawak Report.

By 2019, Lee & Man had pulled out and the receivers and Mokhtar had ended up in a legal battle as the former exercised their right to re-tender the asset whilst Mokhtar tried to injunct them.

The post-coup election in Sabah in 2020 turned the tide back in Mokhtar’s favour as his old friends from UMNO returned to control the state. In 2021 the tycoon was granted fresh approval to complete his original purchase deal by September 2021 and a key renewal of his timber licenses (suspended following his earlier failures to fulfil commitments).

These were granted in return for commitments on his part to return thousands of jobs, the continuation of forest management and commercial tree planting, the resumption of pulp and paper or a related industry

In the event, the receivers claim that Mokhtar failed to perform his side of the deal or to show proof of funds. Instead, they claim he approached them for 50% discount on the purchase price i.e. a RM600m instead of the RM1.2bn that the company is still valued at on the open market!

As the deal failed to complete, wrangling between Mokhtar and the receivers boiled down to who retained the right to the deposit paid in 2018 and an ugly battle to prevent the receivers from re-tendering the company, which the receivers won in court.

At that point the friendly folk from UMNO in the Sabah state government of Hajiji Noor stepped in with an extraordinary manoeuvre to cut the ground from beneath the feet of the receivers, who had hoped to re-float the company and resolve SFI’s debts to several international banks, which include Standard Chartered and Hong Kong Shanghai Bank. Hajiji Noor suddenly announced (without any apparent prior consultation or scoping for their plan) a cancellation of SFI’s timber licences, followed by a compulsory acquisition of all SFI’s lands, and then gazetted it under the pretext of ‘Forest Management’.

Compulsory acquisition is allowed under state laws for purposes that benefit the public interest, subject to the cabinet’s approval and fair compensation. The plan approved by the CM has opined that the appropriate compensation will be just RM256 million!

And, surprise upon surprise, probing by local parliamentarians has elicited confirmation that the beneficiary of this ‘public interest’ acquisition will be Syed Mokhtar who will be allowed to take over the land as long as he pays that compensation to the receivers who are the rightful owners of the RM1.2 billion asset!

The Chief Minister confirmed the matter when answering a question from his predecessor Shafie Apdal May 24th:

We decided to give the concession to Tan Sri Mokhtar Al-Bukhary’s company, so far it hasn’t worked, but we are just giving him two years. If it doesn’t work, we will cancel the agreement [Hajiji bin Haji Noor]

This means that UMNO’s favourite tycoon who originally offered RM1.2 bn for SFI as part of a package to keep jobs and a working industry in the state, and then tried to twist the vendors arms to get it for half price after failing to make good on that deal for years, is now being helped by Hajiji Noor to run off with the prized Sabah asset for a steal at just RM256 million!

What could have motivated the chief minister and his cabinet to agree to such a wonderful cheap deal for Malaysia’s ‘concession king’ at a time when their grip on power is already tenuous and they rule the state by the skin of their teeth?

After all, the receivers have already been combing the market for a new buyer and established they can easily obtain bids at the original valuation of RM1.2 billion from genuine players in the forest management business, in which Mokhtar himself has no experience.

Heaven forbid that Mokhtar simply sub-contracts his underpriced bonanza for a massive profit. So much for compulsory purchase in the public interest. Were he to do so it remains unclear as to who comprises his consortium of collaborators who would all profit likewise, but, in the absence of such basic transparency, people in Sabah are entitled to make an educated guess or two.

What is clear is that the Sabah leadership, in favouring Mohktar in this way, has flagrantly undermined the legitimate interests of several powerful international banking institutions who had provided credit on the basis that SFI was a reliable asset in a law abiding country.

These will inevitably contest this action through the international courts and Sarawak Report understands these banks and their lawyers are confident of their case and certain that the government of Sabah will be found to have acted like highway robbers to benefit a local hustler.

If so, as we have already pointed out, it is once again the people who stand to lose having been fleeced once more by the irresponsible actions of their leaders which could land the state with massive legal penalties that taxpayers will be forced to pay.