Malaysia has played its part in making its most senior public official, ex-Prime Minister Najib Razak (dubbed Malaysian Official One by the US Department of Justice), accountable for the massive thefts from 1MDB.

Yet ,what about those who enabled Najib, from the US banking and legal community in particular?

Sadly, 2025 ended with a far less edifying scenario in that respect, with the paltry sentence of just two years (subject to being shortened for good behaviour) handed down to the only senior non-Malaysian figure from Goldman Sachs to face charges in the matter, the Southeast Asia boss Tim Leissner.

Only his Malaysian subordinate, Roger Ng (now giving evidence to investigators in KL) received any real punishment, a ten year sentence, for the active collaboration of this powerful bank, which netted record fees ($600 million plus) and therefore record bonuses for all its top personnel.

Likewise, a full decade after the fraud was exposed, Malaysia has struggled to bring to book the transatlantic law firm White & Case for its own key role in providing the legal cover and assurances which were vital to carrying out the thefts.

Legal Enablers

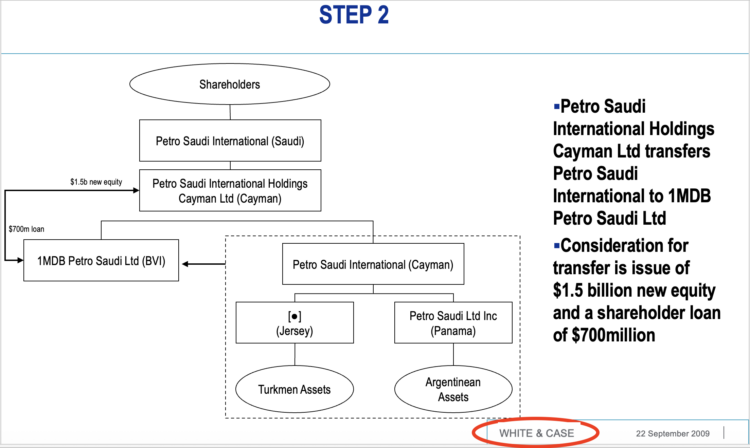

It is at last made known that law enforcers across international borders have begun criminal investigations into the role of White & Case, which from 2009 through 2011 first restructured the fraudulent entity PetroSaudi, incorporating new off-shore ‘subsidiaries’ that provided a false picture of its assets, and then concocted a bogus loan between those subsidiaries as a first step to disguise the theft of an eventual $2.83 billion dollars that was ploughed by 1MDB into the so-called joint venture, cum loan, cum investment, cum unit trust purchase.

All the iterations of this fraud, until well into 2011, were conducted under the auspices and with the collaborati0on of White & Case as the advisors to PetroSaudi. The highly suspicious nature of these transactions appears to have been overlooked by the law firm: surely at best a staggering failure of due diligence given the consequences of the misinformation provided to 1MDB?

For example, when 1MDB’s lawyers Wong & Partners requested details, just hours before the initial billion dollars was released, of the account into which $700 million was being detoured from the supposed joint venture, White & Case confirmed that it was registered in the name of PetroSaudi.

The explanation given was that the enormous sum represented the repayment of a loan made by one PetroSaudi subsidiary to another, an obligation that had been written into the joint venture contract which White & Case had been highly instrumental framing as PetroSaudi’s lawyers.

This provision was allegedly justified on the basis that PetroSaudi had for its part injected valuable oil assets worth $2.9 billion into the joint venture.

Except, the account did not belong to PetroSaudi it belonged to Good Star Limited owned by Najib’s proxy, the fraudster Jho Low, to whom all that money went. Moreover, no loan had ever actually been made, and the ‘valuable’ oil assets were not PetroSaudi’s to inject: neither were they valuable. They were in fact of zero value, owing to an international boundary dispute that had frozen any foreseeable prospect of exploiting the purported concession in the Caspian Sea.

White & Case was perfectly positioned to be aware of the truth in all of the above matters. In particular Sarawak Report has ascertained:

a) Having drawn up the most recent representations of the company’s international structure, following its engagement in the incorporation of new subsidiaries and transference of alleged assets, White & Case knew full well that Good Star Limited did NOT feature within that company group structure.

At the very least the law firm should have confirmed the official ownership of the account into which the $700 million was to be paid and required absolute proof from PetroSaudi’s directors and the Seychelles company registry before falsely informing Wong & Partners, as they did by email, that the account belonged to a subsidiary of PetroSaudi.

b) As PetroSaudi’s lawyers, White & Case were closely involved in the negotiations with the Canadian company Buried Hill from which PetroSaudi had obtained a short-term option to potentially buy the rights to its ‘Serdar’ oil concession in the Caspian Sea.

Nonetheless, the law firm allowed their clients to misrepresent this option as a genuine PetroSaudi asset in order to extract the massively advantageous terms obtained under its joint venture agreement with 1MDB. Those terms included the agreement (which never received board approval) that 1MDB would repay the fictitious $700 million loan allegedly made by one PetroSaudi subsidiary to another.

White & Case were aware no loan was ever made by PetroSaudi International to the 1MDB Petro Saudi limited(later used for the joint venture) as officially claimed. The latter had not even set up its bank account to receive the money on the date it was allegedly made on September 25th 2011. Correspondence with the bank concerned from White & Case makes clear the law firm knew this fact. Indeed, the US Department of Justice has confirmed the account was only opened on September 30th after the money was allegedly already ‘returned’ (removed from the billion dollar ‘investment’ made by 1MDB).

Emails prove the firm knew that the legal letters drawn up by White & Case confirming the payment and then the repayment on behalf of PetroSaudi were exchanged simply to “legitimise” the pre-payment by 1MDB.

c) White & Case were also involved in the moves initiated by PetroSaudi to immediately dissolve the option agreement with Buried Hill within days of the 1MDB deal and the arrival of $300 million of Malaysia’s public money into its company accounts.

By this point the duplicity of the deal, which was entirely based on the alleged asset that PetroSaudi was now severing all potential claim to, ought surely to have become abundantly clear to White & Case. Yet the law firm continued to act and provide cover for this fraudulent client.

“Briefly, we can value the Argentinean assets at around $50-$75m and the Turkmenistan asset at around .. $1b-$1.5b after the border dispute is resolved. .. If we do the deal we want with the Canadian company that currently owns the asset in Turkmenistan, we will also pick up a block in the Gambia but the value of this unclear at this point” [Patrick Mahony laying out PetroSaudi’s ‘assets’ to Jho Low at the very start of the planned fraud in August 2009]

d) Despite later denials made to Sarawak Report, it is also abundantly clear that relevant personnel at White & Case knew that the overseers of the joint venture deal were secretly Jho Low and his personal Malaysian lawyer Tiffany Heah.

Emails show that the original drafting behind the joint venture agreement was prepared by Heah and Low before being sent on to PetroSaudi’s Investment Officer, Patrick Mahony. Mahony in turn sent the proposals to White & Case to be refined and formalised into the joint venture contract. There is no question from these emails that relevant parties at the law firm knew this was the case: from this it ought surely to have deduced that PetroSaudi was acting as a willing front for Jho Low rather than negotiating a genuine deal with the official representatives from 1MDB.

Indeed, when the 1MDB management team was flown over to the UK to negotiate and sign the hastily concocted joint venture contract, just days before the deal was concluded, two adjacent rooms were hired within White & Case’s own offices in London. The second room was to accommodate Jho Low and his team who oversaw the events separated only by the thin paneling as Patrick Mahony and his team shuttled between the two sets of players.

The knowledge of the law firm about the real state of affairs is confirmed by further emails sent just after those negotiations, in which Mahony required that White & Case should allow Tiffany Heah access to the law firm’s London offices to perform a supervisory check on the paperwork so that Jho Low could then signal to the prime minister of Malaysia that all was satisfactory for him to sign off on the agreement.

White & Case acceded to this request. Therefore, they effectively knew who was orchestrating the whole affair and would have known that the later denials by 1MDB, Jho Low and PetroSaudi, saying that Jho Low had no involvement in these matters were lies.

e) Within weeks of the remaining $300 million entering the PetroSaudi Joint Venture account, White & Case became engaged in negotiating on behalf of their client to invest that cash not in the purported agreed joint venture project in Turkmenistan (which was both hopeless and also in the process of being exited by their client) but in PetroSaudi’s actual investment ambitions in Venezuela.

These investments had nothing to do with 1MDB – they were not discussed with or controlled by the Malaysian fund and the profits were due to PetroSaudi only – despite all the investment having come from 1MDB, supposedly for a joint venture elsewhere.

White & Case, despite being entirely in the know about the joint venture contract and the money that had entered from Malaysia, nonetheless continued to engage in the management of PetroSaudi’s activities in Venezuela.

f) White & Case continued to act for PetroSaudi in assisting the changes to the arrangements in 2010 that enabled the joint venture to be allegedly dissolved before 1MDB had to file its first accounts, which would have inevitably revealed the $700 million theft.

White & Case experts were drafted in to help instead frame the Murabaha (‘Islamic’) loan arrangement that exited 1MDB from the joint venture and turned the arrangement into a loan to PetroSaudi instead.

The revised deal furthermore extended that loan to allow the company to borrow a further $833 million from the fund over the ensuing year. $330 million of that money went again directly into the bogus Good Star account; much of the remainder went indirectly, via PetroSaudi, to buy out Jho Low’s holding in UBG.

Emails show that relevant personnel at White & Case were aware the ‘Islamic’ loan had been illegally back-dated by 1MDB (the purpose was to avoid detailing the joint venture in the public accounts) and that the provisions of the loan comprised dishonest ‘window dressing’ in terms of being Islamic, which they were not.

1MDB has already filed a $1.83 billion civil case against White & Case (the entire sum injected into the joint venture) for what it clearly believes amounts to a gross failure to ensure its client had provided honest information during the several stages of negotiations where the law firm had acted for them.

As courts have now ruled, PetroSaudi defrauded 1MDB in a conspiracy with Jho Low and Najib. Yet, White & Case failed to restrain them or report them, despite the glaring evidence and their own enabling role. Instead, the law firm allowed itself to be used to give credibility to a fraudulent deal.

The news that law enforcers in both Malaysia and the UK are now also investigating criminal allegations confirms they believe there is sufficient evidence to suggest that decision makers at White & Case were indeed aware of the dishonesty at play.

‘Financial Enabler Number 1’ – Goldman Sachs

A decade on there remain equal concerns about the role of top decision makers at the top US bank Goldman Sachs. The US Department of Justice played a crucial role in exposing the outrageous $6.5 billion bond fraud that was separately facilitated by the bank in the second stage of looting from 1MDB.

Thanks to the arrest of Southeast Asia boss Tim Leissner and his agreement to provide a full confession the investigation obtained comprehensive details of the crime which have been used to expose Najib, Jho Low, several 1MDB and IPIC/Aabar sovereign fund officials and Leissner’s own deputy Roger Ng.

However, whilst these have either been punished or remain on the run, no effort has been made by the US law enforcers to bring other senior figures at the bank criminally to book. Yet, a review of Leissner’s own public statement to the court back in 2018 provides damning evidence that this Goldman Sachs conspirator was ready to expose senior people at the bank who were fully aware of the fraud and the pay-offs to political players. This is what he said:

During the course of the conspiracy, I conspired with other employees and agents of Goldman Sachs very much in line of its culture of Goldman Sachs to conceal facts from certain compliance and legal employees of Goldman Sachs, including the fact that Jho Low, who is identified as Co-Conspirator Number 1 in the information, was acting as a intermediary for on behalf of Goldman Sachs, 1MDB, and Malaysian and Abu Dhabi officials.

As stated in the information, on one occasion in 2012, I told a committee at Goldman Sachs that Jho Low was not involved in one of the bond transactions. This was not true. I knew that concealing Jho Low’s involvement as an intermediary was contrary to Goldman Sachs’s stated internal policies and procedures.

I and several other employees of Goldman Sachs at the time also concealed that we knew that Jho Low was promising and paying bribes and kickbacks to foreign officials to obtain and retain 1MDB business for Goldman Sachs, for the benefit of Goldman Sachs and myself, and using some of the proceeds of the 1MDB bonds to do so. I knew that this was contrary to Goldman Sachs’s stated policies and procedures.

As a result of these bribes and kickbacks, and in movement of the funds through the bribes and kickbacks, Goldman Sachs received substantial business from 1MDB. The three bond deals and related transactions resulted in substantial fees and revenues for Goldman Sachs, of which and in many cases, it was very proud of at the time. In addition, I received large year-end bonuses as an employee.

Despite these several powerful references to senior co-conspirators at Goldman Sachs back in 2018 the US law enforcers appear to have done nothing to hold these corrupt financiers accountable, allowing them to walk away with enormous bonuses made from defrauding Malaysia.

In the meantime, civil suits reported by this website have spelt out how the most senior people at the bank chose to ignore and ostracise those partners and personnel who warned that the 1MDB bond deals were plainly corrupt and should not be further engaged in by the bank. Indeed, the CEO himself had met with Jho Low, who had already been Red Flagged by the bank’s compliance arms as a high risk individual to be avoided at all cost, at least three times.

Yet, when the DOJ concluded its dealings over Goldman’s role it chose to take money in lieu of prosecuting the bank, exacting a record $2.9 billion fine as part of a so-called Deferred Prosecution Agreement with the bank.

The shameful deal, which doubtless earned several career boosting plaudits for prosecutors involved and a huge injection of resources for their department, has effectively let a swathe of clearly dishonest individuals off Scott free in return for a tiny slice of the annual profits made by the bank – a dent in the the Christmas bonus in lieu of ending up behind bars.

The US anti-kleptocracy initiative was disbanded by DOJ’s present Attorney General Pam Bondi as one of the very first actions of the incoming Trump administration in 2025.

It would be shameful and retrograde if, having made an example of Najib and some others, guilty parties from professions that hold a vital role of trust in keeping corruption at bay should simply be let off to service future kleptocrats – themselves no longer the target of any scrutiny.